Canalys, an analysis agency, recently released a report. In the third quarter of 2023, the Chinese smartphone market saw a decline in shipments for two consecutive quarters, with a year-on-year decrease of 5% to 66.7 million units. Looking at data from different manufacturers, Honor reclaimed the top position with an 18% market share and shipped 11.8 million units. OPPO secured the second spot with 10.9 million shipments. Apple closely followed with 10.6 million units. Vivo adopted a cautious shipping strategy and ranked fourth with a 16% market share. Xiaomi’s market share saw a slight increase to 14%, maintaining the fifth position. Additionally, Huawei, through its successful launch of the Mate series, continued to gain market share.

Honor Regains Top Spot in Shipments in Q3 2023

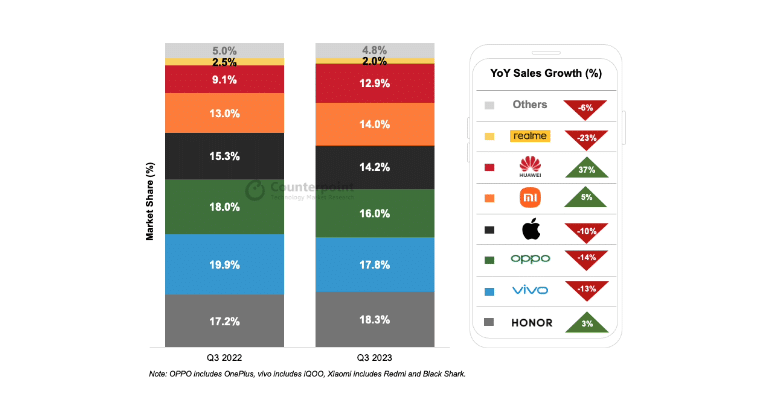

In the 2023 Q3 domestic smartphone market report, Honor regained the top spot in shipments, and Huawei’s market share witnessed a significant 37% increase.

According to the latest report from market research firm Counterpoint Research, smartphone sales in the Chinese market in the third quarter of 2023 decreased by 3% compared to the previous year, signaling a narrowed decline, suggesting that the market had hit its lowest point and was showing signs of recovery.

Statistical data reveals that Honor dominated the market with an 18.3% market share, thanks to the recently launched Honor X50 and Honor 90 smartphones.

Alicia Kong, a research analyst, observed, “Both Honor and Xiaomi are actively focusing on offering more affordable mid-range products and promotional prices to retailers and consumers in order to counteract any potential downward pressure.” This strategy has proven to be effective.”

Huawei’s Market Share Grows by 37% in Q3 2023

In the third quarter, Huawei’s sales performance was particularly impressive, with smartphone shipments growing by 37% year-on-year. Senior analyst Ivan Lam stated that the sales of the Mate 60 series were carried out as part of the pioneer program and mostly realized through channel sales. The product quickly gained wide attention through the brand’s offline and online channels, and Huawei is working to increase production to meet the demand.

OPPO, Vivo, and Apple all experienced double-digit declines in sales. Senior analyst Ivan Lam mentioned, “The decline in iPhone sales was due to channel price reductions happening earlier than expected, and official price adjustments did not offset this impact. Additionally, supply constraints during the launch of the iPhone 15 series led to lower sales compared to the iPhone 14 series.”

OPPO, Vivo, and Apple Experience Declines in Sales

Traditional offline leaders, OPPO and Vivo, were impacted by weak consumer demand in second-tier and lower-tier cities, with their promotional efforts falling slightly behind those of Honor and Xiaomi. Sales of foldable smartphones continued to grow, with OPPO’s Find N2 Flip remaining the top-selling model among foldable devices, while Honor’s Magic V2 took the lead in the segment of horizontal foldable smartphones.

Huawei will return with its latest flagship products and Qualcomm will release its new generation processor, causing significant fluctuations in the Chinese smartphone market in the fourth quarter of 2023. An increase in Huawei’s shipments and market share is foreseeable, although many currently believe that Huawei’s return would impact Honor the most. However, according to the latest report from Counterpoint Research, Honor’s current sales depend largely on the Honor X50 and Honor 90, both targeting the low-end and mid-range markets, with distinct pricing differences from Huawei’s flagship product, the Mate 60 Pro. Huawei is targeting the high-end flagship market.

The Qualcomm Snapdragon 8 Gen3 brought significant performance improvements, and various smartphone manufacturers eagerly launched models featuring this chip. These new-generation smartphones not only offer enhanced performance and improved camera capabilities but also focus on AI models in various domains.

For instance, Honor, the current market leader in terms of market share, announced its Magic 6 series, featuring the Qualcomm Snapdragon 8 Gen3, and stated that it would support 7 billion parameters on-device AI models within its system. During the recent Qualcomm Snapdragon Summit, Honor showcased some of the features of its on-device AI model for smartphones.

Read Also: Canalys Releases 2023Q2 Global Wearable Wristband Device Report