Q3 2023 For India Report that despite a 3% year-on-year decline in smartphone shipments in the Indian Mobile Phone Market, this quarter witnessed an improvement in the consumer environment, providing an opportunity for manufacturers to launch new devices.

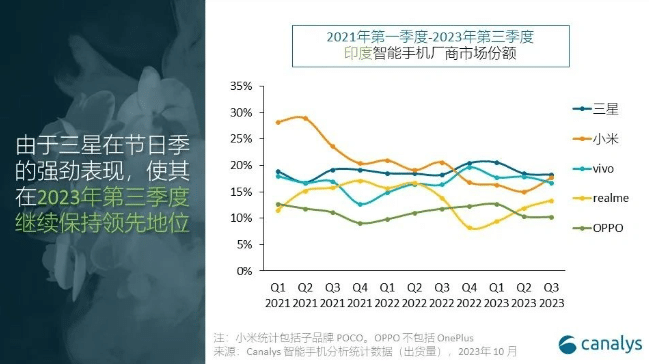

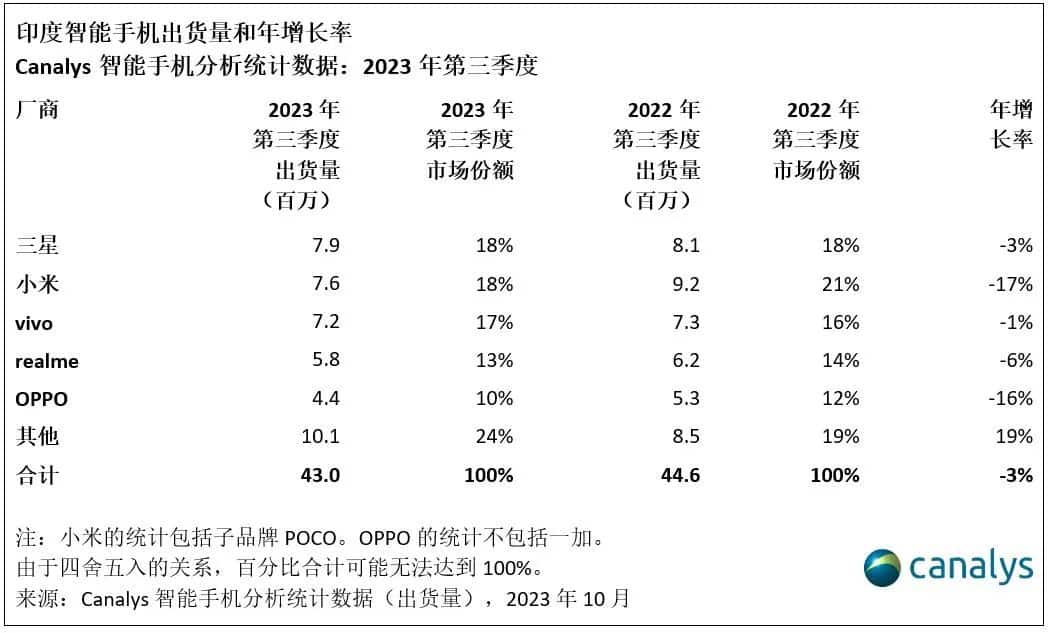

In the third quarter of 2023, Samsung maintained its leading position, holding an 18% market share with shipments of 7.9 million units.

- Xiaomi, propelled by the release of high-value 5G models, secured the second position with 7.6 million units shipped.

- Vivo claimed the third spot with shipments totaling 7.2 million units.

- Realme and OPPO (excluding OnePlus) established themselves in the top five with 5.8 million and 4.4 million units shipped, respectively.

According to Canalys‘ Senior Analyst Sanyam Chaurasia, major smartphone brands in the Indian Mobile Phone Market strategically promoted their festive product portfolios in the third quarter, emphasizing high-value 5G offerings. Additionally, these brands launched their latest products, leveraging the advantage of improved inventory for most manufacturers during this quarter.

Entry-Level 5G Devices Surge in Demand

As manufacturers introduced 5G models for the mass market, there was a surge in demand for entry-level 5G devices in the Indian market. For instance, Xiaomi introduced the Redmi 12 5G and POCO M6 Pro 5G, expanding their 5G product selection. Realme also attracted market attention with the 11x 5G and 11 5G models, especially through online channels.

With 5G smartphones becoming increasingly mainstream, Motorola, Infinix, and Tecno also unveiled affordable 5G devices to stimulate limited shipments.

On the other hand, the high-end market continued to grow steadily. Samsung’s S23 series and Apple’s iPhone 14 and iPhone 13, among other older models, experienced strong sales during the festive season, driving growth in the high-end market. Honor, in collaboration with HTech, re-entered the Indian market and introduced the Honor 90 series models.

However, Chaurasia also noted that despite the declining shipments for the top five manufacturers, other brands demonstrated resilience, resulting in stable overall market shipment performance.

Brands like OnePlus, Infinix, Tecno, and Motorola achieved robust growth by expanding their channel presence, increasing product supply, and capitalizing on the positive momentum they had built during the chip shortage experienced by top manufacturers in 2021.

In the face of current challenges, it is difficult for manufacturers to simultaneously maintain market share, manage inventory, and sustain profitability. For example, OPPO shifted its focus by introducing higher-priced models, prioritizing profitability over shipments.

Samsung and Xiaomi Maintain Top Two Positions in Q3 2023 India Smartphone Market

Samsung has streamlined its product portfolio across various price segments. In the macroeconomic environment and amid local operational obstacles and demand fluctuations, manufacturers need to assess their market position. To achieve long-term growth, top manufacturers should prioritize building a strong distribution network, strengthen integration with local production, and actively contribute to the local economy.

Canalys Q3 2023 for India report claims that although the recovery of consumer confidence in the second half of the year benefits the market, the path to the revival of the Indian smartphone market will still face challenges from global macroeconomic factors. The growth of related markets in 2024 will depend on “uncertain macroeconomic factors,” with entry-level markets being more susceptible to these influences.

The Indian economy shows resilience to these changes, and major brands are gradually adapting to the market’s dynamics. To maintain market share, manufacturers should focus on reducing channel pressure, crafting a lean product portfolio, launching “star products” in various price segments, and maintaining balanced inventory levels across channels.

Read Also: Canalys Releases 2023Q2 Global Wearable Wristband Device Report