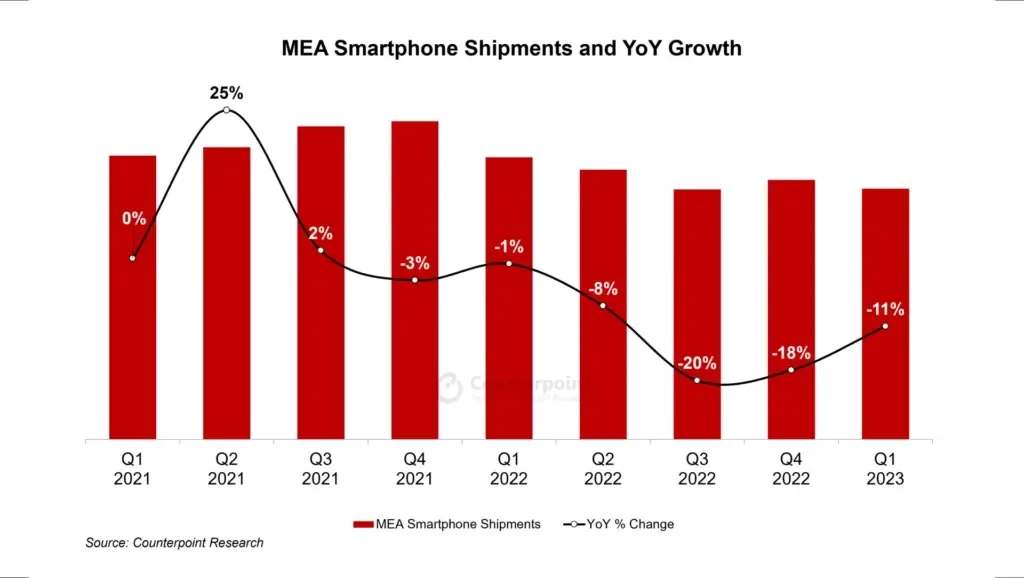

According to the latest Smartphone Shipment report released by the market research firm Counterpoint Research, the shipment volume of smartphones in the Middle East and Africa (MEA) region dropped by 11% year-on-year and 3% month-on-month. This marks the lowest quarterly shipment volume since 2016.

The MEA region is still grappling with economic challenges such as high inflation, local currency depreciation, and weak consumer confidence. OEM smartphone manufacturers continue to compete mainly in the low-end, entry-level market segment. Adjusting inventory, improving channel efficiency, and reducing costs remain the main themes in this region.

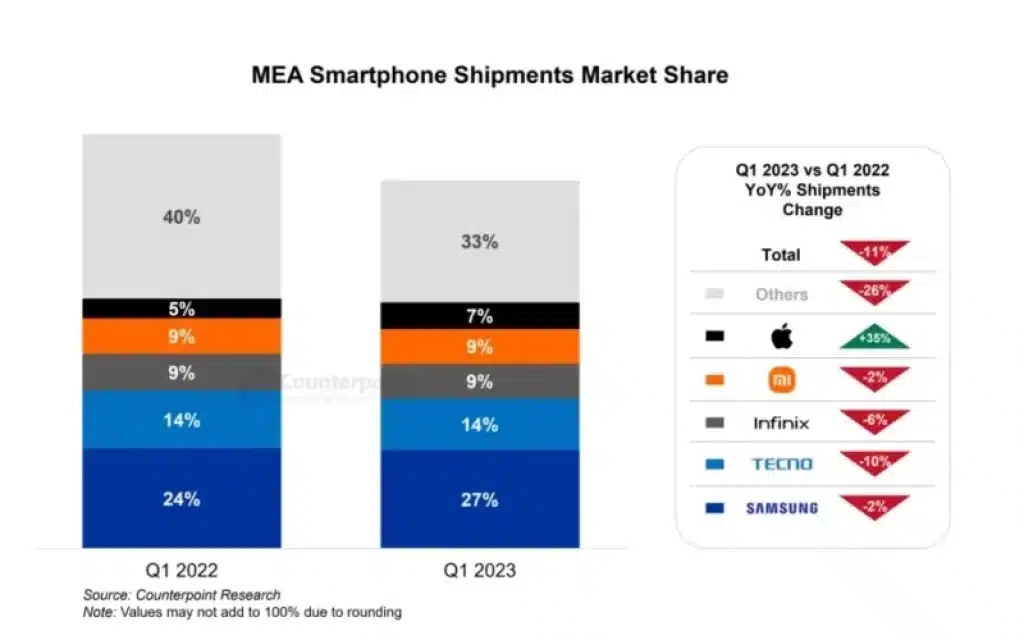

According to this smartphone shipment report shows that in Q1 2023, Samsung ranked first with a market share of 27%, with a year-on-year decrease of 2% in shipment volume. Transsion Tecno ranked second with a market share of 14%, experiencing a 10% year-on-year decrease in shipment volume. Infinix ranked third with a market share of 9%, experiencing a 6% year-on-year decrease in shipment volume. Xiaomi ranked fourth with a market share of 9%, experiencing a 2% year-on-year decrease in shipment volume. Apple ranked fifth with a market share of 7%, experiencing a 35% year-on-year increase in shipment volume.

Read More: Global smartphone market shipments will continue to drop next year

The report suggests that the COVID-19 pandemic has caused consumers in the MEA region to become more price-sensitive, leading them to opt for cheaper smartphones. The trend of upgrading smartphones has slowed down, and people are holding onto their devices for longer periods.