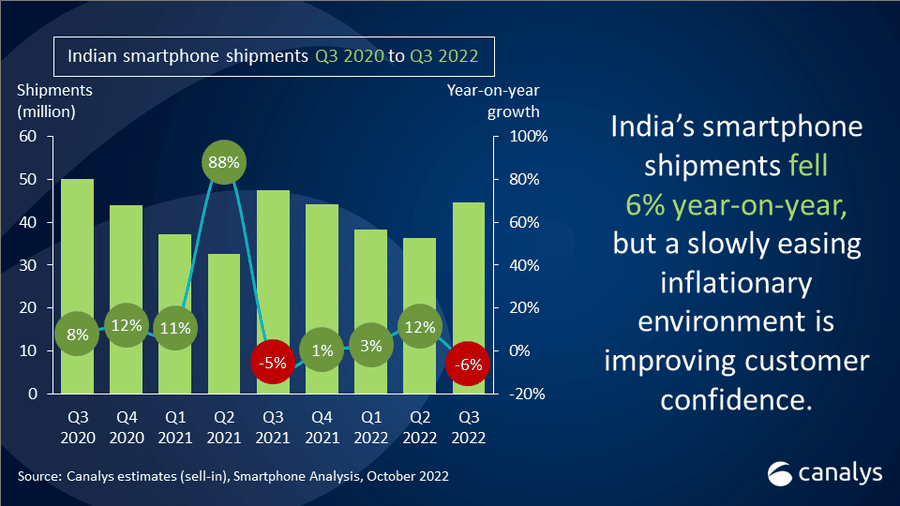

Canalys is among those market research companies that provide trustworthy and accurate information, forecasts, and stats for various niches. That’s why, every time this company releases a new report, we hurry to take a look at it. Today, it released the latest data for the Indian smartphone market. In the third quarter, the market showed a significant downward trend. It was down by about 6% compared to last year. As for simple numbers, the OEMs sold 44.6 million units in the country.

Also read: Xiaomi Is The Number One Smartphone Vendor In June

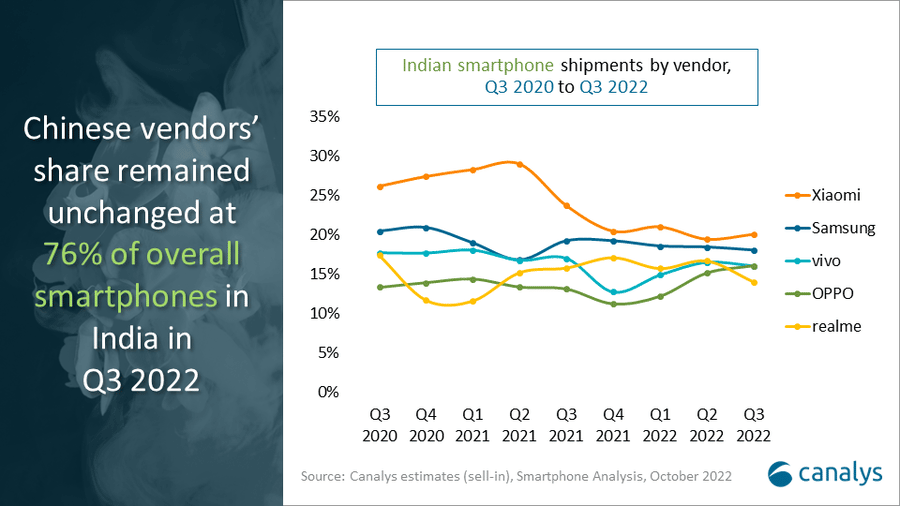

What’s more interesting, Xiaomi has monopolized one-fifth of the market. Thus, Xiaomi will not give way to other brands and will remain India’s number-one smartphone maker for many consecutive quarters.

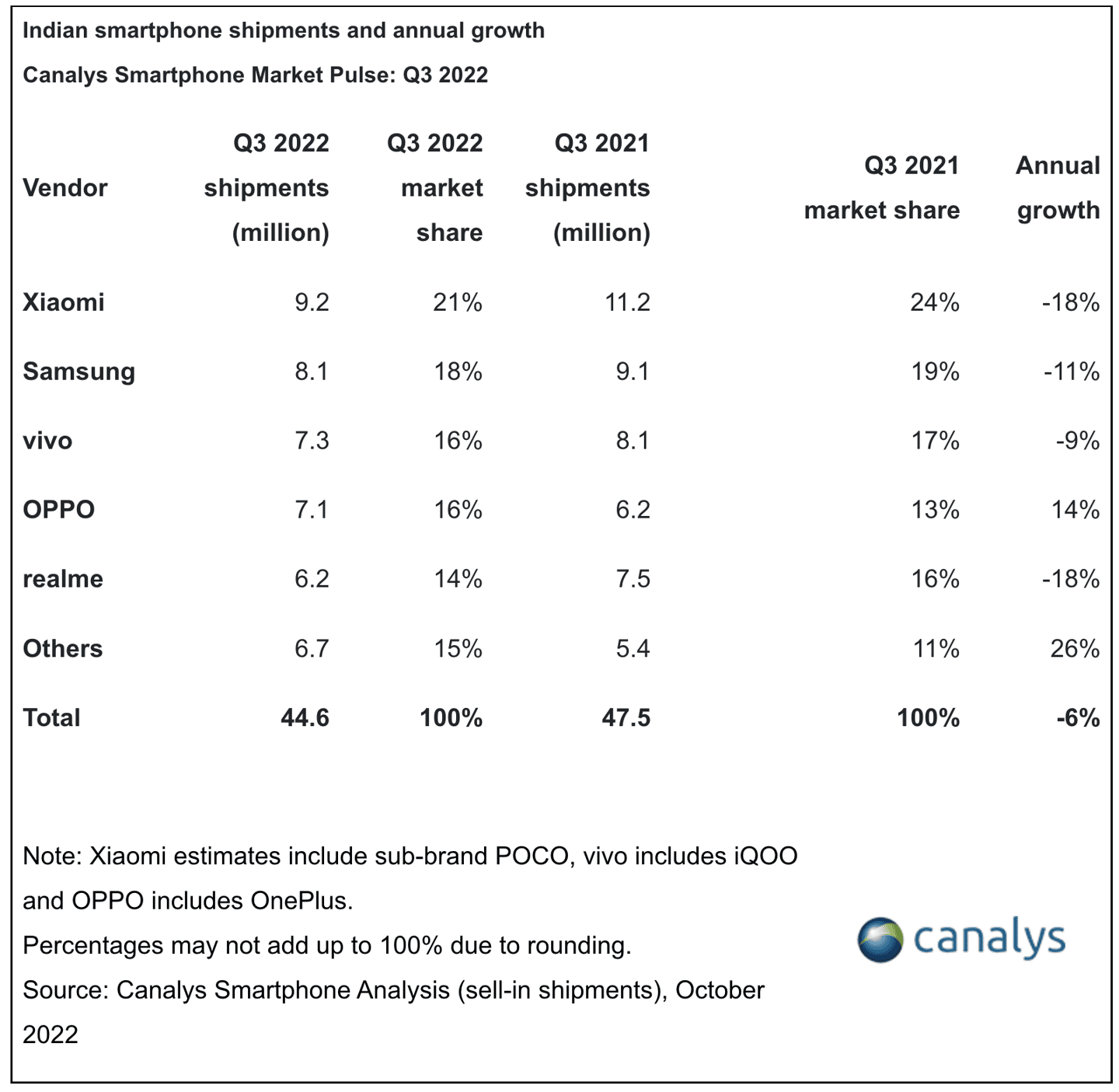

Specifically, during the statistical period, Xiaomi shipped 9.2 million units, accounting for 21%. Samsung ranked second with 8.1 million units shipped. This is enough to capture 18% of the market. VIVO shipped 7.3 million units, accounting for 16%, ranking third. OPPO shipped 7.1 million units, accounting for 16%. Realms also appeared in the top five, with 6.2 million shipped units and a market share of 16%.

Looking at the previous quarters’ report, we can see that Xiaomi has been in this seat for two years. Thus, for two years, no brand could dethrone Xiaomi in India. This quarter’s lead has further expanded compared to the previous quarter.

Previously, Canalys released the global smartphone report for the third quarter of 2022, showing that Xiaomi also achieved very gratifying results in the global market. It was lying behind only the two giants, Apple and Samsung. The company ranked third with 14%.

“Early Monsoon and Independence Day online sales were great opportunities for vendors to clear inventory before heading into the festive season,” said Canalys Analyst Sanyam Chaurasia. “The good news is, as the festival season began, in the last few weeks of the quarter, consumer demand improved. Hit by inflation, entry-level device contribution declined this year, while the mid-to-high segment performed relatively well thanks to aggressive promotions. OPPO’s OnePlus and vivo’s iQOO were the two brands driving mid-range growth in the e-commerce channel during this period. Ultra-premium category smartphones, especially older generation flagships, also experienced strong demand momentum amid price cuts. Samsung offered deep discounts on its older generation Galaxy Z Fold3 and latest Galaxy S22 series in online and offline channels. Similarly, demand for the aggressively discounted iPhone 13 outstripped the latest iPhone 14, whose value proposition is very similar to the former.”